$600K, 72% leased with $2M upside in 2 Years

| Overview |

|---|

| Invest $150K = 12.5% Equity |

| Returns: 1.5x by 2027 ($225K) |

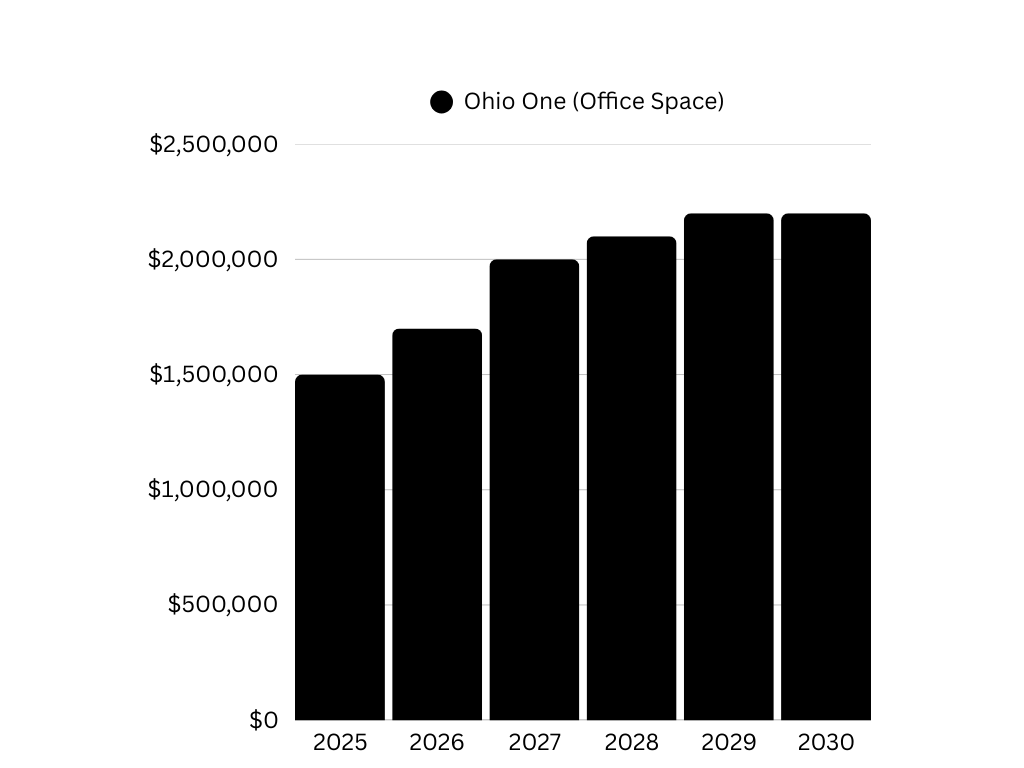

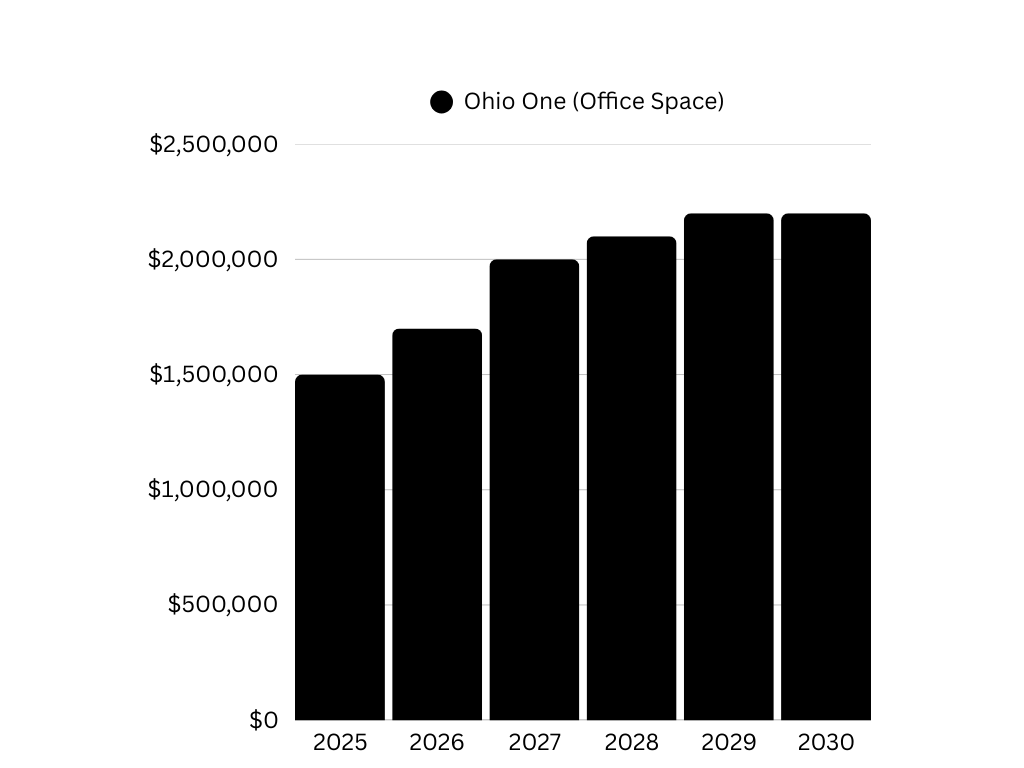

Built as Ohio Edison’s Headquarters, Ohio One is a 65,000 sq ft downtown property—695 tons of steel, beautiful brick property with 30,000 sq ft of marble finishes. This central business district property offers unmatched value compared to nearby comps at $32-$46/sq ft, with a valuation of $1.5M already locked in.

| Year | Occupancy | NOI | Value | Cap Rate |

|---|---|---|---|---|

| Now | 72% | $41K | $600K | 7% |

| 2025 | 78% | $81K | $1.5M | 5.4% |

| 2027 | 85% | $174K | $2M | 8.7% |

| Year | Occupancy | NOI | Value | Cap Rate |

|---|---|---|---|---|

| Now | 72% | $41K | $600K | 7% |

| 2025 | 78% | $81K | $1.5M | 5.4% |

| 2027 | 85% | $174K | $2M | 8.7% |

Eric Holm: Leads an organization that built and rehabbed 200 Ohio homes; now converting a 110,000 sq ft historic school into a community hub.

Drew Pierce: CPA with $100M in real estate experience, specializing in development and lease-up for $3M–$20M projects.

Ryan Kelly: Runs a 3D printing construction tech firm, adept at funding and government navigation.

Bottomline: Ohio One is well positioned to build value on office NOI to $2M valuation in 2027.

Seeking $750K LP equity—$150K secures 12.5% ownership

| Overview |

|---|

| Invest $150K = 12.5% Equity |

| Returns: 1.5x by 2027 ($225K) |

Invest in Downtown Youngstown’s Premier Commercial Real Estate – Ohio One Building